Buying a home with fair credit

A new Zillow analysis shows that nationally buyers with fair credit scores could be paying up to 288 more on their monthly mortgage payment than those with excellent credit. Free one-on-one HUD-approved housing counseling.

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

Lock Your Rate Before Rates Increase.

. Knowing how much home you can afford lets you focus your energy on shopping for homes. CNBC Select reveals what credit score you realistically should have to get approved for a loan. Apply See If Youre Eligible for a Home Loan Backed by the US.

See Todays Rate Get The Best Rate In A 90 Day Period. Most mortgage lenders will provide prime-level loan rates. Ad Mortgage Rates Have Been on the Decline.

May be layered with grants and credits to assist eligible buyers with down payment and closing costs. Browse available listings today. Compare Quotes See What You Could Save.

Ad Buying a Home Can Be Easy. Getting A Mortgage With Fair Credit Contrary to popular belief its actually possible to get a mortgage with fair credit. Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

If you have a 600. Population with a credit score has a perfect 850 but. Consider an FHA-backed mortgage.

Most negative items can only stay on your credit report. In some cases the best thing you can do to ensure you have a clean credit report before buying a house is simply to wait. Determine how much home you can afford.

Guaranteed Rate has mortgage options for homebuyers with credit scores of 580 or above and all mortgage programs are available to borrowers with a credit score of 620 or above. Just note many VA loan lenders require a minimum score of 580. Ad Find Mortgage Lenders Suitable for Your Budget.

One way to determine that is by estimating its fair market value or FMV. It Only Takes Minutes to See What You Qualify For. A credit score between 580-669 ranks.

Dont Waist Extra Money. Just 16 of the US. Its generally recommended that you keep your utilization.

FHA financing FHA mortgages allow borrowers to finance. Learn more about our fully managed co-ownership model. You can also meet one-on-one with a HUD-approved housing counselor who can help you make a step-by-step plan to buy a.

Mortgage lenders and the Federal Housing Administration FHA look at a credit score range when considering a home mortgage loan. In effect lenders want those with fair credit to get financing. Low 3 down payment on a conventional fixed-rate mortgage.

Own at 18 the cost. If you have fair credit mortgages to consider include. Qualifying home buyers can use the VA loan program with 0 down so its a great option for first-time buyers.

Ad Find The Best Rates for Buying a Home. Ad Buying a Home Can Be Easy. Ad Are you eligible for low interest rates.

Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. How To Improve Your Credit Score Before Buying. In general the fair market value of a home or any other property is the price that would be supported on.

You dont need perfect credit to purchase a home. But a higher credit score can make the approval process easier and it can definitely save you money. For example if you have 50000 in available credit and 20000 in credit card debt your utilization rate would be 40.

Let Americas 1 Online Lender Help. Receive Your Rates Fees And Monthly Payments. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

Compare Offers Apply Get Pre-Approved Today. Apply Today Save. Find all FHA loan requirements here.

If you have a. Get Offers From Top Lenders Now. Ad Pacaso is making the dream of owning a second home a reality.

Get Preapproved You May Save On Your Rate. If youve never applied for a mortgage you have never seen your mortgage credit report. Those include buying an energy-efficient home having very good credit scores showing conservative use of credit or having substantial savings balances.

Let Americas 1 Online Lender Help. Check your credit report for errors.

Usda Loan Pros And Cons Usda Loan Understanding Mortgages Mortgage

97 Real Estate Infographics How To Make Your Own Go Viral Home Buying Process Home Mortgage Mortgage Process

Average Credit Score To Buy A House Bankrate

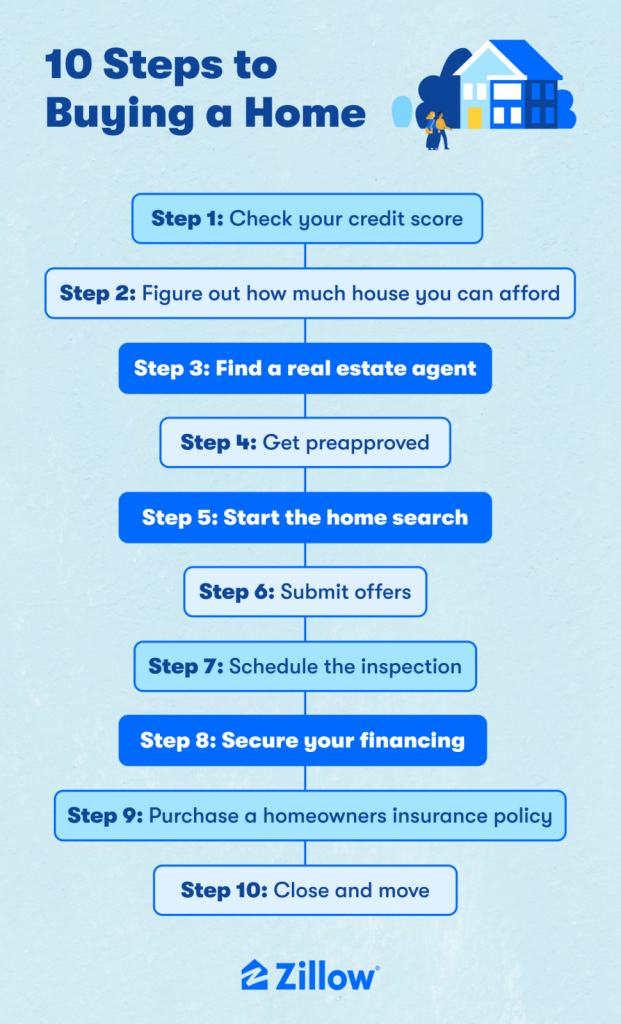

10 Most Important Steps To Buying A House Zillow

Looking To Buy A Home With Poor Credit Best And Worst Cities To Apply For A Mortgage Usa Today Buying Foreclosed Homes Sell Your Own Home Selling House

What Is A Good Credit Score To Buy A House Or Refinance Mortgage Loans Credit Score Fha Loans

Printable Checklist For Finding The Right Home Home Buying Credit Repair Companies Credit Repair Business

Credit Score Information For Kentucky Home Buyers Mortgage Loans Good Credit Score Good Credit

Does Your Credit Score Matter When Renting A Home Renting A House Credit Score Good Credit Score

Equal Housing Opportunity Vinyl Decal Sticker Fair Car Window Office Door Sign Ebay Refinance Mortgage Line Of Credit Home Equity

How To Get A Mortgage With Awful Credit Finance Advice Bad Credit Personal Finance Blogs

𝐇𝐨𝐰 𝐭𝐨 𝐊𝐞𝐞𝐩 𝐘𝐨𝐮𝐫 𝐂𝐫𝐞𝐝𝐢𝐭 𝐒𝐜𝐨𝐫𝐞𝐬 𝐇𝐢𝐠𝐡 𝐃𝐮𝐫𝐢𝐧𝐠 𝐑𝐞𝐭𝐢𝐫𝐞𝐦𝐞𝐧𝐭 𝐢𝐧 𝐂𝐨𝐥𝐨𝐫 Credit Score Retirement Credit Monitoring

Pin On Buying A House With Bad Credit

Home Buyer Finance Checklist Happy House Preapproved Mortgage Check Your Credit Score

What Credit Score Do You Need To Buy A House In 2022 Ally

High Credit Equals Lots Of Benefits Good Credit Equality Benefit

Your Credit Score Directly Impacts Your Mortgage Interest Rate But There Are Options Available At Almos Mortgage Interest Rates Mortgage Interest Credit Score